量化學習 | 配對交易 backtrader實現

配對交易,其基本原理就是找出兩只走勢相關的股票。這兩只股票的價格差距從長期來看在一個固定的水平內波動,如果價差暫時性的超過或低於這個水平,就買多價格偏低的股票,賣空價格偏高的股票。等到價差恢復正常水平時,進行平倉操作,賺取這一過程中價差變化所產生的利潤。

其實就是找到兩個關聯性高的股票A和B,做出調倉策略,如果覺得當前A價格過高就換B,這里的假設是歷史走勢相關性高,那么未來也是相關性高的,這里並不無道理,如果現在的價格是相關的,未來短期相關的假設是可以接受的。

那我們可以用tushare獲取銀行行業的股票,基本面相同的情況下,我們認為其走勢相關性更高,再在這個范圍找出兩個相關性高的股票。

本文大部分分析都是根據這篇文章做出的:https://bigquant.com/community/t/topic/260

我這里首先封裝了一下tushare的常用獲取接口后面通過**from stock_api import ***來獲取

import tushare as ts

mytoken = 'your_token'

ts.set_token(mytoken)

pro = ts.pro_api()

def get_daily(ts_code, start_date, end_date):

# get stock daily price and other info from start_date to end_date

try:

df = pro.daily(ts_code=ts_code,

start_date=start_date,

end_date=end_date)

except Exception as e:

print('Retry, We get error:', e)

df = get_daily()

return df

def get_stock_basic():

# get all stock basic info

try:

df = pro.stock_basic(

exchange='',

list_status='L',

fields='ts_code,symbol,name,area,industry,list_date')

except Exception as e:

print('Retry, We get error:', e)

df = get_stock_basic()

return df

def get_daily_basic(trade_date):

# get all stock daily_basic info

try:

df = pro.daily_basic(

ts_code='',

trade_date=trade_date,

fields='ts_code,trade_date,turnover_rate,volume_ratio,pe,pb')

except Exception as e:

print('Retry, We get error:', e)

df = get_daily_basic(trade_date)

return df

def get_income(code, start_date, end_date):

try:

income = pro.income(ts_code=code,

start_date=start_date,

end_date=end_date,

fields='ts_code,basic_eps,diluted_eps')

except Exception as e:

print('Retry, We get error:', e)

income = get_income(code, start_date, end_date)

return income

獲取行業股票構造字典

import backtrader.plot

import matplotlib

import matplotlib.pyplot as plt

import tushare as ts

from datetime import datetime

import backtrader as bt

import pandas as pd

import os

from stock_api import *

import numpy as np

import statsmodels.api as sm

import seaborn as sns

data = get_stock_basic()

last_year = '20180101'

start_date='20190102'

end_date='20200103'

instruments_code_bank = list(data[data.industry=='銀行']['ts_code'])

prices_temp=pd.DataFrame()

for c in instruments_code_bank:

c_daily = get_daily(c,start_date,end_date)

prices_temp=prices_temp.append(c_daily)

prices_temp_code_close=prices_temp[['ts_code','close']]

# 獲取20190102-20200103的股票出現最多的交易日期長度

# 因為有一些20190102以后中途出現停牌的情況

mode_num = np.argmax(np.bincount([len(i) for i in [prices_temp_code_close[prices_temp_code_close.ts_code==c] for c in instruments_code_bank]]))

print(mode_num) # 246

# 構造字典通過ts_code索引這一年的收盤價

price_dict_all = dict(list(prices_temp_code_close.groupby('ts_code')['close']))

# 篩選出字典中交易日期跟眾數相等的股票,這樣才可以分析出更多再股票池里相關性高的一對

price_dict = dict(filter(lambda x:len(x[1])==mode_num, price_dict_all.items()))

instruments_code=list(price_dict.keys())

print(instruments_code)

銀行股票代碼是下面這個列表:

['000001.SZ', '002142.SZ', '002807.SZ', '002839.SZ', '002936.SZ', '600000.SH', '600015.SH', '600016.SH', '600036.SH', '600908.SH', '600919.SH', '600926.SH', '601009.SH', '601128.SH', '601166.SH', '601169.SH', '601229.SH', '601288.SH', '601328.SH', '601398.SH', '601577.SH', '601818.SH', '601838.SH', '601939.SH', '601988.SH', '601997.SH', '601998.SH', '603323.SH']

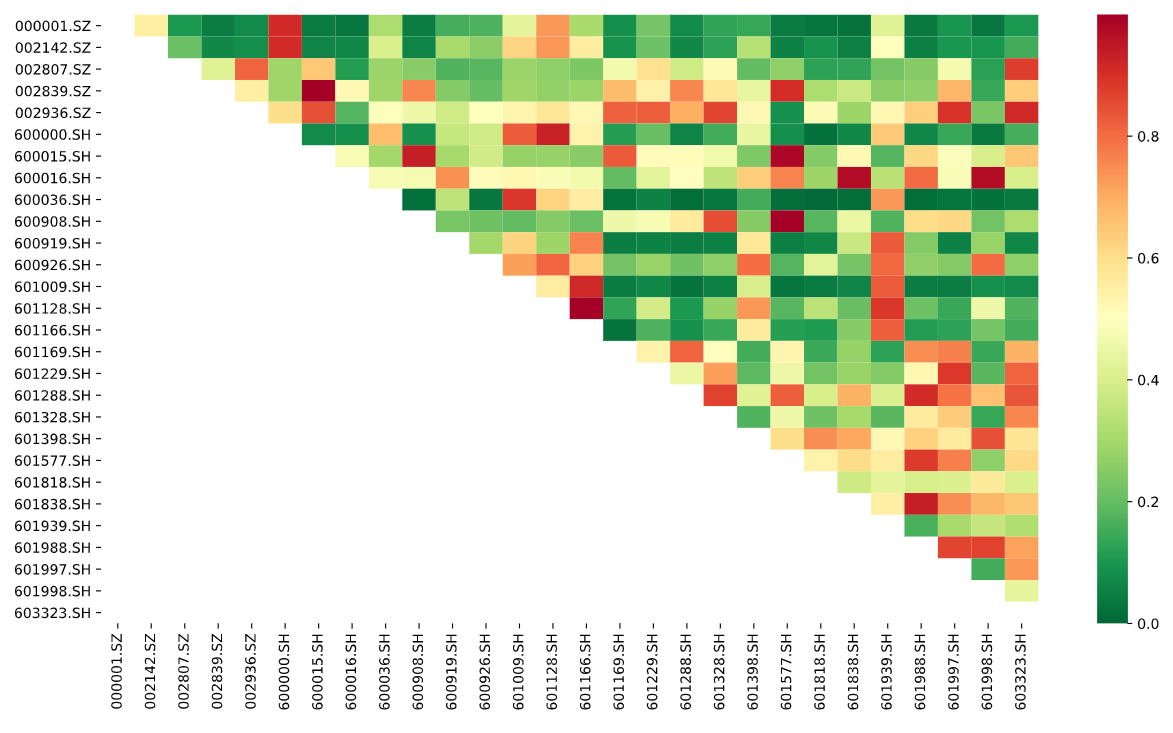

相關性分析

# 輸入是一price_dict,每一列是一支股票在每一日的價格

def find_cointegrated_pairs(price_dict):

# 得到price_dict長度

n = len(price_dict)

# 初始化p值矩陣

pvalue_matrix = np.ones((n, n))

# 抽取列的名稱

keys = list(price_dict.keys())

mode_num = np.argmax(np.bincount([len(i) for i in list(price_dict.values())]))

print("keys:",keys)

# 初始化強協整組

pairs = []

# 對於每一個i

for i in range(n):

# 對於大於i的j

stock1 = price_dict[keys[i]]

if len(stock1)!=mode_num:

continue

for j in range(i+1, n):

# 獲取相應的兩只股票的價格Series

stock2 = price_dict[keys[j]]

if len(stock2)!=mode_num:

continue

# 分析它們的協整關系

result = sm.tsa.stattools.coint(stock1, stock2)

# 取出並記錄p值

pvalue = result[1]

pvalue_matrix[i, j] = pvalue

# 如果p值小於0.05

if pvalue < 0.05:

# 記錄股票對和相應的p值

pairs.append((keys[i], keys[j], pvalue))

# 返回結果

return pvalue_matrix, pairs

pvalues, pairs = find_cointegrated_pairs(price_dict)

pairs_df = pd.DataFrame(pairs, index=range(0,len(pairs)), columns=list(['bank1','bank2','pvalue']))

#pvalue越小表示相關性越大,按pvalue升序排名就是獲取相關性從大到小的股票對

pairs_df=pairs_df.sort_values(by='pvalue')

pairs_df

這里是相關性分析,每個股票之間都做sm.tsa.stattools.coint的協整性關系計算,p值小於0.05的放進pairs里考慮,p值越小相關性越高。

%matplotlib inline

plt.rcParams['figure.figsize'] = [15, 8]

sns.heatmap(1-pvalues, xticklabels=instruments_code, yticklabels=instruments_code, cmap='RdYlGn_r', mask = (pvalues == 1))

股票對的相關性熱度圖:

熱度圖中越紅表示相關性越高,表示p值越小

pairs_df是下面這個表格顯示:

| bank1 | bank2 | pvalue |

|---|---|---|

| 601128.SH | 601166.SH | 0.000734 |

| 600908.SH | 601577.SH | 0.002515 |

| 002839.SZ | 600015.SH | 0.002777 |

| 600015.SH | 601577.SH | 0.012600 |

| 600016.SH | 601838.SH | 0.027678 |

| 600016.SH | 601998.SH | 0.030310 |

可以看到601128.SH 和601166.SH 相關性最高,他們是

- 601128.SH 常熟銀行 X

- 601166.SH 興業銀行 Y

# bank_choose = ['601128.SH','601166.SH']

bank_choose = [pairs_df.iloc[0].bank1,pairs_df.iloc[0].bank2]

# bank_choose

x = price_dict[bank_choose[0]]

y = price_dict[bank_choose[1]]

X = sm.add_constant(x)

result = (sm.OLS(y,X)).fit()

print(result.summary())

OLS Regression Results

==============================================================================

Dep. Variable: close R-squared: 0.853

Model: OLS Adj. R-squared: 0.852

Method: Least Squares F-statistic: 1415.

Date: Fri, 20 Mar 2020 Prob (F-statistic): 1.51e-103

Time: 22:43:54 Log-Likelihood: -160.79

No. Observations: 246 AIC: 325.6

Df Residuals: 244 BIC: 332.6

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 6.1175 0.324 18.883 0.000 5.479 6.756

close 1.5575 0.041 37.617 0.000 1.476 1.639

==============================================================================

Omnibus: 9.358 Durbin-Watson: 0.324

Prob(Omnibus): 0.009 Jarque-Bera (JB): 9.387

Skew: 0.468 Prob(JB): 0.00915

Kurtosis: 3.199 Cond. No. 86.5

==============================================================================

可以看到OLS線性回歸之后,算出它們是以什么系數線性組合的系數構成平穩序列的。

Y = 1.5575*X + 6.1175

畫出數據和擬合線:

fig, ax = plt.subplots(figsize=(8,6))

ax.plot(x, y, 'o', label="data")

ax.plot(x, result.fittedvalues, 'r', label="OLS")

ax.legend(loc='best')

后面我想觀察一下601128.SH 常熟銀行 X 和601166.SH 興業銀行 Y是否真的相關,歷史行情看一下走勢,為此封裝了一下plotly.graph_objects的函數:

def plot_scatter(fig, y, x=None, name=None, title=None, show=True):

fig.add_trace(go.Scatter(y=y, x=x, name=name))

fig.update_layout(title=title)

if show:

fig.show()

這里[::-1]都是為了把dataframe或者list倒過來,因為tushare獲得的數據都是從最近的日期排下來的,譬如我這里20200103是index為0的數據,所以這里我為了畫圖倒過來了。

trade_date = prices_temp['trade_date'].unique()

date_series = pd.to_datetime(trade_date[::-1])

date_series

fig = go.Figure()

plot_scatter(fig, y=price_dict[bank_choose[0]][::-1], x=date_series, name=bank_choose[0], show=False)

plot_scatter(fig, y=price_dict[bank_choose[1]][::-1], x=date_series, name=bank_choose[1], show=True)

fig = go.Figure()

plot_scatter(fig, y=y-1.5575*x, x=date_series, name='Stationary Series', show=False)

plot_scatter(fig, y=[np.mean(y-1.5575*x)]*len(y), x=date_series, name='mean', show=True)

買賣時機的判斷

這里,我們先介紹一下, z−score 是對時間序列偏離其均值程度的衡量,表示時間序列偏離了其均值多少倍的標准差。首先,我們定義一個函數來計算 z−score:

一個序列在時間 t 的 z−score,是它在時間 t 的值,減去序列的均值,再除以序列的標准差后得到的值。

def zscore(series):

return (series - series.mean()) / np.std(series)

zscore_calcu = zscore(y-1.5575*x)

fig_bs=go.Figure()

plot_scatter(fig_bs,zscore_calcu,date_series,name='zscore',show=False)

plot_scatter(fig_bs,[0.]*len(y),date_series,name='Mean',show=False) # np.mean(zscore_calcu)=0.

plot_scatter(fig_bs,[1.]*len(y),date_series,name='upper',show=False)

plot_scatter(fig_bs,[-1.]*len(y),date_series,name='lower',show=True)

其實很簡單的策略,就是當zscore大於1的時候我們認為Y的估值相對X已經過高,考慮賣出Y買入X,當小於-1的時候相反。

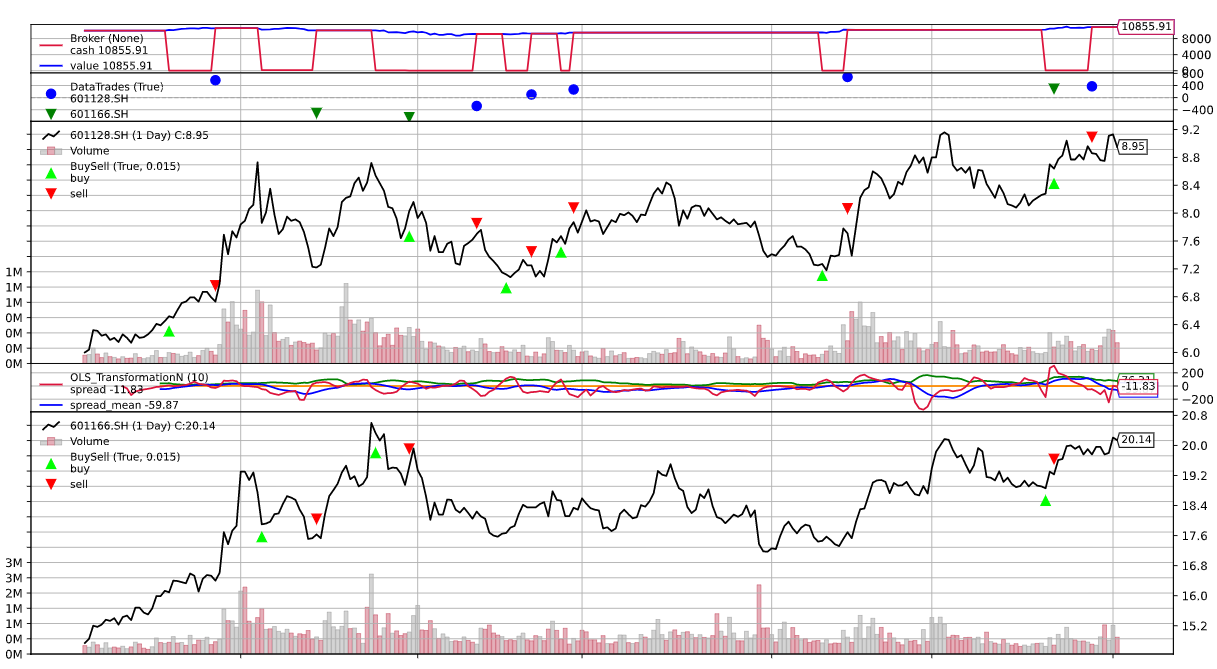

backtrader策略實現

1.交易標的:601128.SH 常熟銀行 X和601166.SH 興業銀行 Y

2.交易信號: 當zscore大於1時,全倉買入data0常熟銀行,全倉賣出data1興業銀行→做空價差 當zscore小於-1時,全倉賣出data0常熟銀行,全倉買入data1興業銀行→做多價差

策略如下,寫完策略可以直接傳遞給runner:

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class PairTradingStrategy(bt.Strategy):

params = dict(

period=10,

qty1=0,

qty2=0,

printout=False,

upper=1,

lower=-1,

up_medium=0.5,

low_medium=-0.5,

status=0,

)

# 這里說明一下;self.p.upper即可訪問params里的參數,這是bt.Strategy里實現的

# 所以這里params一般都是聲明跟策略相關的變量,可以通過self.p的屬性進行獲取

def log(self, txt, dt=None):

if self.p.printout:

dt = dt or self.data.datetime[0]

dt = bt.num2date(dt)

def notify_order(self, order):

if order.status in [bt.Order.Submitted, bt.Order.Accepted]:

return # Await further notifications

if order.status == order.Completed:

if order.isbuy():

buytxt = 'BUY COMPLETE, %.2f' % order.executed.price

self.log(buytxt, order.executed.dt)

else:

selltxt = 'SELL COMPLETE, %.2f' % order.executed.price

self.log(selltxt, order.executed.dt)

elif order.status in [order.Expired, order.Canceled, order.Margin]:

self.log('%s ,' % order.Status[order.status])

pass # Simply log

# Allow new orders

self.orderid = None

def __init__(self):

# To control operation entries

self.orderid = None

self.qty1 = self.p.qty1

self.qty2 = self.p.qty2

self.upper_limit = self.p.upper

self.lower_limit = self.p.lower

self.up_medium = self.p.up_medium

self.low_medium = self.p.low_medium

self.status = self.p.status

# Signals performed with PD.OLS :

self.transform = btind.OLS_TransformationN(self.data0, self.data1,

period=self.p.period)

self.zscore = self.transform.zscore

def next(self):

if self.orderid:

return # if an order is active, no new orders are allowed

if self.p.printout:

print('Self len:', len(self))

print('Data0 len:', len(self.data0))

print('Data1 len:', len(self.data1))

print('Data0 len == Data1 len:',

len(self.data0) == len(self.data1))

print('Data0 dt:', self.data0.datetime.datetime())

print('Data1 dt:', self.data1.datetime.datetime())

print('status is', self.status)

print('zscore is', self.zscore[0])

if (self.zscore[0] > self.upper_limit) and (self.status != 1):

self.status = 1

self.order_target_percent(self.data1,0) # data1 = y

self.order_target_percent(self.data0,1) # data0 = x

elif (self.zscore[0] < self.lower_limit) and (self.status != 2):

self.order_target_percent(self.data0,0) # data0 = x

self.order_target_percent(self.data1,1) # data1 = y

self.status = 2

def stop(self):

print('==================================================')

print('Starting Value - %.2f' % self.broker.startingcash)

print('Ending Value - %.2f' % self.broker.getvalue())

print('==================================================')

根據之前寫過的策略,我封裝了一個Strategy_runner,后面繼承為多數據策略的runner,這里不看也不妨礙理解:

from datetime import datetime

import backtrader as bt

import pandas as pd

import os

import tushare as ts

import matplotlib

import matplotlib.pyplot as plt

from stock_api import get_daily

matplotlib.use('agg')

data_path = './data/'

if not os.path.exists(data_path):

os.makedirs(data_path)

mytoken = 'your_token'

class Strategy_runner:

def __init__(self,

strategy,

ts_code,

start_date,

end_date,

data_path=data_path,

pro=True,

token=mytoken):

ts.set_token(mytoken)

pro = ts.pro_api()

self.ts_code = ts_code

self.start_date = start_date

self.end_date = end_date

self.data_path = data_path

# convert to datetime

self.start_datetime = datetime.strptime(start_date, '%Y%m%d')

self.end_datetime = datetime.strptime(end_date, '%Y%m%d')

df = self.read_save(self.ts_code, pro)

self.df_bt = self.preprocess(df, pro)

self.strategy = strategy

self.cerebro = bt.Cerebro()

def read_save(self, ts_code, pro=True):

if pro:

csv_name = f'pro_day_{str(ts_code)}-{str(self.start_date)}-{str(self.end_date)}.csv'

else:

csv_name = f'day_{str(ts_code)}-{str(self.start_date)}-{str(self.end_date)}.csv'

csv_path = os.path.join(self.data_path, csv_name)

if os.path.exists(csv_path):

if pro:

df = pd.read_csv(csv_path)

else:

df = pd.read_csv(csv_path, index_col=0)

else:

if pro:

# self.pro = ts.pro_api()

# self.df = self.pro.daily(ts_code=self.ts_code, start_date=self.start_date, end_date=self.end_date)

df = get_daily(ts_code, self.start_date, self.end_date)

if not df.empty:

df.to_csv(csv_path, index=False)

else:

df = ts.get_hist_data(ts_code, str(self.start_datetime),

str(self.end_datetime))

if not df.empty:

df.to_csv(csv_path, index=True)

return df

def preprocess(self, df, pro=False):

if pro:

features = ['open', 'high', 'low', 'close', 'vol', 'trade_date']

# convert_datetime = lambda x:datetime.strptime(x,'%Y%m%d')

convert_datetime = lambda x: pd.to_datetime(str(x))

df['trade_date'] = df['trade_date'].apply(convert_datetime)

bt_col_dict = {'vol': 'volume', 'trade_date': 'datetime'}

df = df.rename(columns=bt_col_dict)

df = df.set_index('datetime')

# df.index = pd.DatetimeIndex(df.index)

else:

features = ['open', 'high', 'low', 'close', 'volume']

df = df[features]

df['openinterest'] = 0

df.index = pd.DatetimeIndex(df.index)

df = df[::-1]

return df

def run(self):

data = bt.feeds.PandasData(dataname=self.df_bt,

fromdate=self.start_datetime,

todate=self.end_datetime)

self.cerebro.adddata(data) # Add the data feed

self.cerebro.addstrategy(self.strategy) # Add the trading strategy

# self.cerebro.broker.setcash(1000.0)

# self.cerebro.addsizer(bt.sizers.FixedSize, stake=100)

self.cerebro.broker.setcommission(commission=0.0) # 佣金

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

self.results = self.cerebro.run()

strat = self.results[0]

print('Final Portfolio Value: %.2f' % self.cerebro.broker.getvalue())

print('SR:', strat.analyzers.SharpeRatio.get_analysis())

print('DW:', strat.analyzers.DW.get_analysis())

return self.cerebro, strat

def plot(self, iplot=False):

plt.rcParams['figure.figsize'] = [15, 8]

self.cerebro.plot(iplot=iplot)

def test():

from SmaCross import SmaCross

ts_code = '600515.SH'

start_date = '20190101'

end_date = '20191231'

strategy_runner = Strategy_runner(strategy=SmaCross,

ts_code=ts_code,

start_date=start_date,

end_date=end_date,

pro=True)

results = strategy_runner.run()

strategy_runner.plot()

return results

if __name__ == '__main__':

test()

繼承封裝為其投入多條股票數據,主要就是多一個ts_code1:

from Strategy_runner import Strategy_runner

data_path = './data/'

if not os.path.exists(data_path):

os.makedirs(data_path)

mytoken = 'your_token'

class Multidata_Strategy_runner(Strategy_runner):

def __init__(self, strategy, ts_code, ts_code1, start_date, end_date, data_path=data_path, pro=True, token=mytoken):

super().__init__(strategy, ts_code, start_date, end_date, data_path=data_path, pro=True, token=mytoken)

self.ts_code1 = ts_code1

df1 = super().read_save(self.ts_code1, pro)

self.df_bt1 = super().preprocess(df1, pro)

def run(self):

data = bt.feeds.PandasData(dataname=self.df_bt,

fromdate=self.start_datetime,

todate=self.end_datetime)

data1 = bt.feeds.PandasData(dataname=self.df_bt1,

fromdate=self.start_datetime,

todate=self.end_datetime)

self.cerebro.adddata(data, name=self.ts_code) # Add the data feed

self.cerebro.adddata(data1, name=self.ts_code1) # Add the data feed

self.cerebro.addstrategy(self.strategy) # Add the trading strategy

# self.cerebro.broker.setcash(1000.0)

# self.cerebro.addsizer(bt.sizers.FixedSize, stake=100)

self.cerebro.broker.setcommission(commission=0.0) # 佣金

self.cerebro.addanalyzer(bt.analyzers.SharpeRatio, _name='SharpeRatio')

self.cerebro.addanalyzer(bt.analyzers.DrawDown, _name='DW')

self.results = self.cerebro.run()

strat = self.results[0]

print('Final Portfolio Value: %.2f' % self.cerebro.broker.getvalue())

print('SR:', strat.analyzers.SharpeRatio.get_analysis())

print('DW:', strat.analyzers.DW.get_analysis())

return self.cerebro, strat

run一下:

strategy_runner = Multidata_Strategy_runner(strategy=PairTradingStrategy, ts_code=bank_choose[0], ts_code1=bank_choose[1],start_date=start_date, end_date=end_date, pro=True)

cerebro, strat = strategy_runner.run()

strategy_runner.plot()

==================================================

Starting Value - 10000.00

Ending Value - 10855.91

==================================================

Final Portfolio Value: 10855.91

SR: OrderedDict([('sharperatio', 0.7663305721395932)])

DW: AutoOrderedDict([('len', 12), ('drawdown', 0.9858628237869406), ('moneydown', 108.09000000000015), ('max', AutoOrderedDict([('len', 202), ('drawdown', 18.257629657367524), ('moneydown', 1950.2799999999988)]))])

最后賺了855.91元。

總結

實現過程並不難,主要是為了分析這個策略的可行性,理解其思想,首先配對交易的假設是未來走勢也與現在分析的存在較高相關性,但是是否真是如此,如果后面走勢不一致,以及價值不符合市場,暴跌暴升是否能預測出呢?

完整的代碼可以看我的github repo: